How to Invest in ChatGPT in Australia – The Top 3 ASX ETFs with AI Exposure – 2024

How to Invest in ChatGPT in Australia, without putting all of your eggs in one basket.

Artificial Intelligence has been making monstrous waves since the release of ChatGPT, the platform saw the quickest rise to 100 million users in history. Many investors are now looking to capitalise on this new and exciting industry.

The AI industry is expected to reach over $190 billion by 2025!

While investing in ChatGPT itself may not yet be an option, investors can still get a piece of the AI pie through investments in its partners and peers.

In this blog post, I will highlight the top 3 ASX Exchange Traded Funds (ETFs) with exposure to the AI and tech space.

And as a bonus, If you read to the end you will find the fourth ETF that could be the most important piece of the puzzle for those looking to participate in the AI revolution.

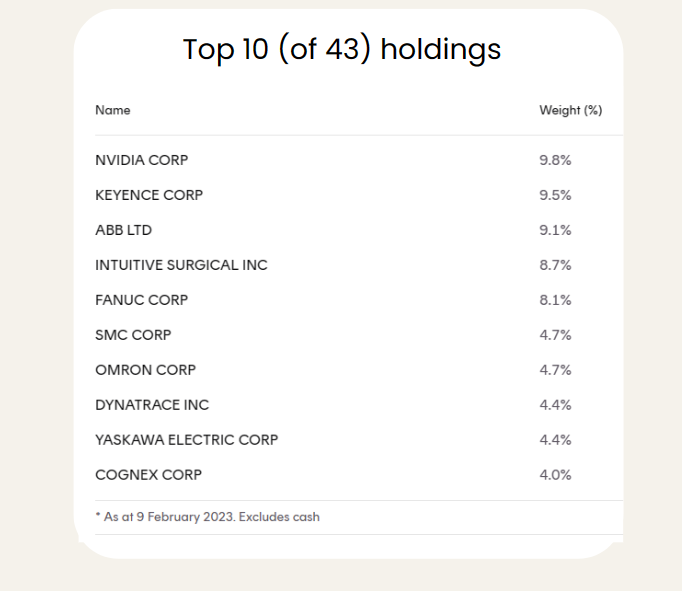

1. Betashares AI & Robotics ETF (ASX: RBTZ)

The Betashares AI & Robotics ETF provides investors with exposure to companies that are actively involved in the development and production of AI and robotics technologies.

This fund gives investors a diverse portfolio of companies from across the world, including leading tech giants like Amazon and Microsoft, as well as smaller, more specialized firms that are at the forefront of the AI and robotics revolution.

Head to the RBTZ ETF provider page

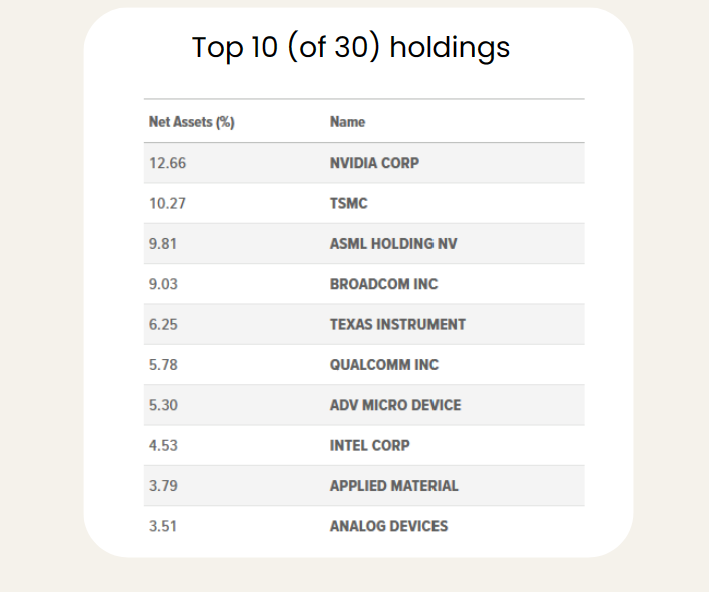

2. Global X Semiconductors ETF (ASX:SEMI)

The development and advancement of AI technology requires unimaginable amounts of computing power.

The Global X Semiconductors ETF provides exposure to the semiconductor industry, which is a crucial component in the development of AI technologies. Companies in this industry are involved in the design, manufacture, and distribution of chips and other components that enable the development of AI technologies.

But it’s not just AI, Semiconductors are critical components in everything electrical or ‘smart’.

Computers, smartphones, televisions, automobiles, the internet of things, and renewable energy to name just a few.

Head to the SEMI ETF provider page

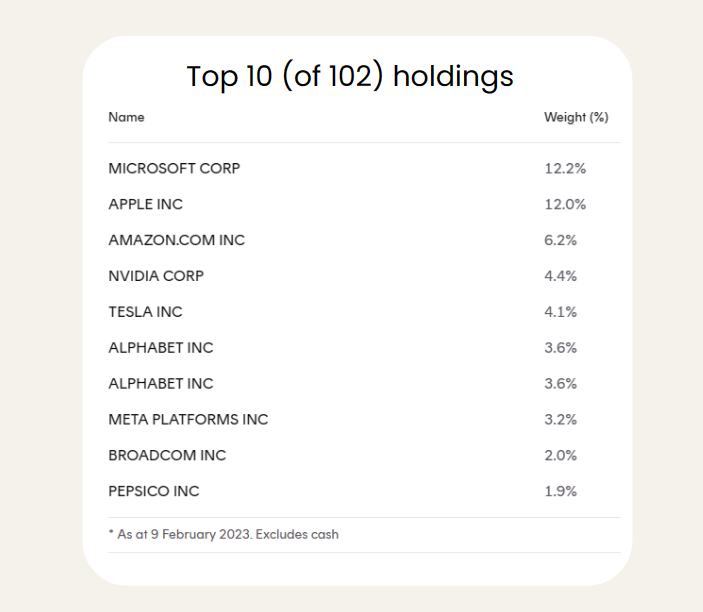

3. Betashares NASDAQ 100 ETF ASX:NDQ

NDQ aims to track the performance of the NASDAQ-100 Index (before fees and expenses). The NASDAQ-100 comprises 100 of the largest non-financial companies listed on the NASDAQ market and includes many companies that are at the forefront of the ‘new economy’.

The NASDAQ 100 is home to many of the world’s largest and most innovative tech companies. This ETF holds a diverse portfolio of global technology companies, including those involved in AI and machine learning, as well as other leading tech firms like Apple and Facebook.

Head to the NDQ ETF provider page

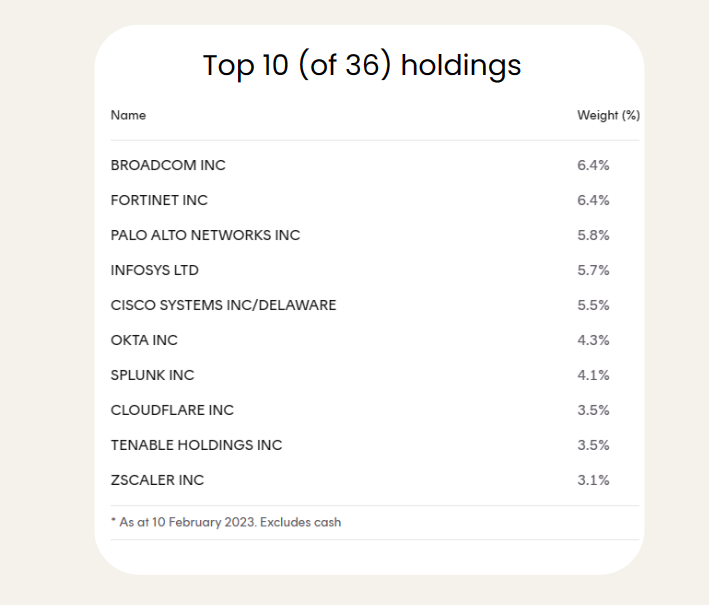

Bonus Investment: The Betashares Global Cybersecurity ETF (ASX: HACK)

AI is projected to play a significant role in the increase of cybercrime. The rise of AI has led to advanced and innovative ways for cybercriminals to carry out their malicious activities, making it even more important for organizations and individuals to invest in cybersecurity measures.

The Betashares Global Cybersecurity ETF (ASX:HACK) provides an opportunity for investors to invest in a fast-growing global sector, with convenient and cost-effective access to a diversified portfolio of global cybersecurity companies.

The fund’s portfolio includes both established global cybersecurity giants and emerging players, offering exposure to current and future industry leaders.

Head to the HACK ETF Provider page

Conclusion

In conclusion, investing in the AI space in Australia has the potential to bring big returns as the technology continues to grow and evolve. With the rise of AI, the huge growth of ChatGPT, and the increasing demand for computing power, it’s no surprise that more and more investors are looking to get involved.

The three ASX ETFs mentioned in this post provide an excellent starting point for those who want to invest in AI and technology without putting all of their eggs in one basket.

**A small portion of this blog may have been written by AI 🙂

Reach out to speak with a JM Investments adviser

Jon Moses

Managing Director JM Investments

The information in this blog post is intended to provide general information only and is not a substitute for professional financial advice. Please consider seeking independent advice from a financial advisor before making any investment decisions. Past performance is not a guarantee of future results, and investing in the stock market involves risk. Additionally, the returns are not guaranteed and you may lose money. It is important to thoroughly research and understand the risks involved in any investment before making a decision.

Hey there, I’m Jon!

I help connect you with your ideal investment portfolio. Personalised service with an ethical footprint.

FINANCE

Investing

LIFE

NEWS

Previous Comments

Leave a Reply